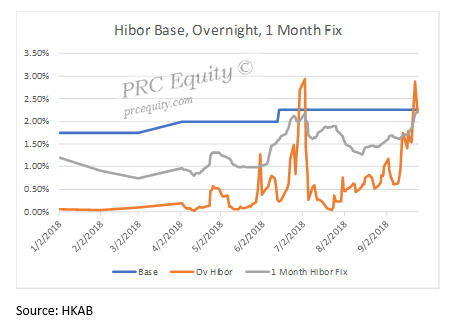

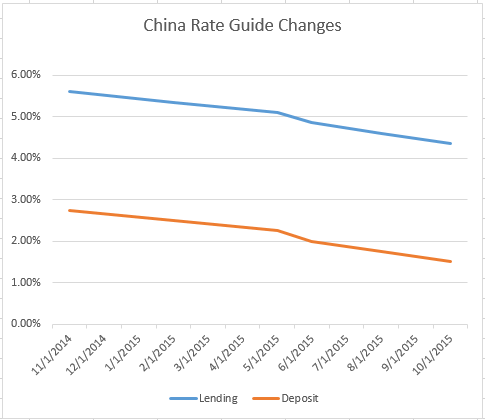

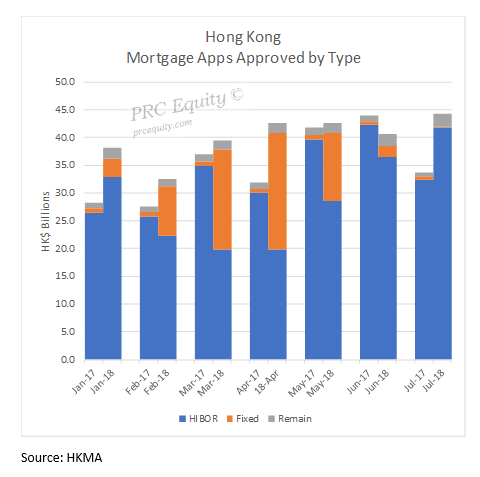

The impact of the Federal Reserve’s rate rise will be far reaching. With the Hong Kong dollar pegged to the greenback, the HIBOR base rate continues to rise.

Although not in strict tandem, short term rates have finally begun to rise.

Despite the inexorable rise in short-term rates, Hong Kong lenders held steadfast until August 8, when HSBC, Hang Seng Bank, Standard Charter and Citibank adjusted their prime rate to an effective rate of 2.25%. This was the first change since 2008. Typically, Hibor linked mortgages revert to prime when a rise in Hibor makes prime-linked mortgages cheaper.

The pain will shortly be felt, as new borrowers have been forced into variable-rate mortgages as banks prepared for the rise.

While Hong Kong banks may adjust to the risk with variable rate loans, developers have less room to avoid the pain. Thanks to the rise in Hong Kong property prices, along with the weaker yuan, and restrictions on mainland development in tier one cities, mainland developers have joined the feast in Hong Kong, but may have come to the table late and without a full menu. Prices and volume appear to have peaked.

Source: Midland Realty

Two of the largest mainland developers, Country Garden, HK 2007 and China Evergrande, HK 3333 bought land at the peak and are therefore vulnerable to a fall.

Mainland developers [are] in a more vulnerable position to any price corrections in the Hong Kong residential market. Their projects in Hong Kong may struggle to break even, or potentially run into losses, if prices decline by more than 15 per cent or 20 per cent,” said Cindy Huang, an analyst at S&P Global Ratings.

UBS has predicted Hong Kong home prices will tumble as much as 10 per cent from this month to the end of 2019, while Citibank forecast a 7 per cent fall in the second half this year.

That is roughly when Evergrande and Country Garden plan to start selling thousands of units now under construction in Tuen Mun and Ma On Shan.

In January, Evergrande Group paid the highest amount per square foot – about HK$8,300 – ever recorded in Tuen Mun, when it bought a site that is expected to be developed into a 1,982-unit project on 8 Kwun Chui Road from Henderson Land Development for about HK$6.5 billion (US$830 million). Henderson reaped an 80 per cent profit on the deal for the land that it bought in June 2015.

Adding in construction costs and interest expenses, the total investment cost for Evergrande’s Tuen Mun project will be about HK$14,410 per square foot.

That means Evergrande will need to sell flats in the development at about HK$16,600 per square foot to generate a reasonable profit of about 15 per cent. However, used homes at a nearby development, Wheelock Properties’ Napa, have been selling for about HK$14,200 per square, which means Evergrande is vulnerable unless home prices continue to climb.

Wheelock Properties, a Hong Kong developer, benefited from buying land early. In 2013, it paid HK$1.39 billion – or just HK$3,683 per square foot – for the Napa site. In 2017, its average flat sold for HK$11,500 per square foot, giving Wheelock a 67 per cent profit, after adding in construction and other costs.

One mainland developer may escape the “late penalty”. Vanke Property (Hong Kong) bought a parcel for HK$3.8 billion in 2015, or HK$4,541 per square foot. That gives it more room to still make a profit if profits begin sliding. To achieve a 15 per cent profit margin, Vanke would only need to price its Le Pont flats at about HK$11,790 per square foot.

“[Vanke Property (Hong Kong)] bought the land relatively early when land in the area was sold at around HK$4,000 per square foot,” said Alvin Lam, director at Midland Surveyors, who added the developer may escape from any possible market downturn as its land price is relatively low.

Like Evergrande, Country Garden also got in late.

Last September, Country Garden paid about HK$2.44 billion, or HK$10,498 per square foot, for a 60 per cent stake in a plot in Ma On Shan owned by Wang On Group.

For Country Garden to net a 15 per cent profit, the 547-unit project would need to sell its flats at about HK$18,219 per square foot.

In contrast, Henderson Land achieved a profit margin of 68 per cent at its nearby Double Cove project by just selling its flats at about HK$15,000 per square foot. It had bought the land there in 2009 for HK$3,253 per square foot.

“These mainland developers have responded to this challenge by slowing down their land purchases in Hong Kong this year, due to expectations of thin margins and tightened financing conditions,” said Huang of S&P Global ratings. “Refinancing pressures continue to hamper mainland developers [however]. This lower rate of land acquisition in Hong Kong is likely to continue.”

Quote Source: South China Morning Post

With the rising prices, Hong Kong has grown to be among the least affordable markets in the world.

Developer stocks, which have seen explosive growth on both the Mainland and Hong Kong have finally been declining, along with the indexes thanks to both the creeping interest rates and the US China trade war. The majority have fallen close to 20% from their peak. There is most likely more pain to come.