China Minsheng Bank 1988 HK, today released a statement that an officer was being interrogated by police over “illegal conduct”. No further details were given regarding the officer, Zhang Ying, the president of Hangtianqiao sub-branch of the Beijing branch of the Company.

The South China Morning Post reported that the conduct was related to the evaporation of 3 billion yuan in a Wealth Management Product, WMP.

If correct, the picture painted is a disturbing one.

The Minsheng case involved an “innovative” WMP in which yields were amplified by purchasing a secondhand WMP. Consecutive interest rate cuts and a flood of WMPs sold on the mainland market over the past three years have already seen wealthy investors shun common WMPs with unattractive yields.

According to investor contracts seen by the South China Morning Post, Minsheng’s private banking customers purchased transferred WMPs from the original investors. Bank employees told the buyers that the original investors urgently needed cash and were willing to cash out of the WMPs, which at the time were not yet due, and forego part of the supposed yields. As a result, the original WMPs that guaranteed principle and at least 4.2 per cent annual return “turned into” a product with more than 8 per cent annual return. Bank employees said the products were exclusively for longstanding private banking customers who owned at least 10 million yuan in financial assets.

Last week an investor happened to ask a friend who works at a bigger branch of Minsheng about the WMP at Hangtianqiao, but was told it didn’t exist. Officials at the Beijing branch of Minsheng subsequently reported Zhang Ying to the police, who then arrested her. By Thursday night all investors had become aware of the situation.

The situation casts doubt on Minsheng’s internal controls and management. Ironically, the company highlighted its wealth management business in its annual results filing:

3. ..The Company vigorously expanded major businesses including asset management, asset custody, financial market and interbank financial services, and actively built the “Apex Asset Management (非凡資產管 理)” brand. As at the end of the Reporting Period, the balance of wealth management products amounted to RMB1,427,816 million, representing an increase of 34.89% as compared with the end of the previous year.

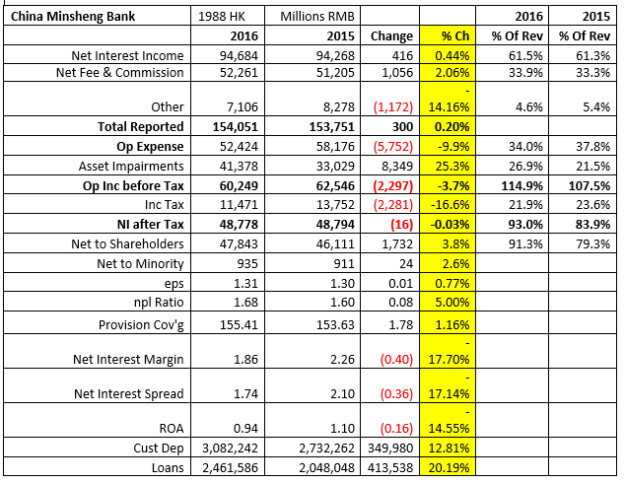

The bank cannot afford bad management or controls as it reported lackluster annual earnings on March 30, with revenue and earnings relatively flat despite 20% loan growth thanks to an increase in impairments of 25% as well as lower net interest margins dropping from 2.26 to 1.86. Loan growth surpassed deposit growth which only increased by 12.8%.

Net income growth would have been negative if it weren’t for the operating expense decline, which was not due to cost savings, but to a May change in reporting from Business Tax to Value Added Tax. (This mid-year accounting nightmare was applicable to finance, life services, property and construction companies. The Big 4 Banks showed the same dramatic decrease in operating expenses.)

Prior to the illegal conduct event, Minsheng was targeted as sell by Deutsche Bank in March, which cited concerns regarding its heavy interests in shadow banking and its reliance on wholesale funding. It’s target price was at $7.31 hkd. At its last close at $7.86 hkd, it had a market cap of 323.7 Billion hkd, ($41.6 US) which would make it about half the size of US Bank, USB, the fifth largest bank in the United States.

Mortgage Loans More than Doubling

Like the majority of Chinese banks, Minsheng saw a major increase in mortgage loans in 2016.

Given the recent sales restrictions imposed by the government after the explosive sales increases in first tier cities, this growth cannot be sustained. There will, however, be an increase in risk if home prices fall.