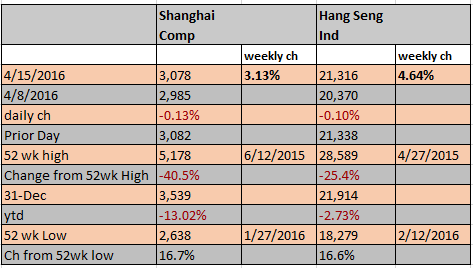

China indexes stalled, with slight drop despite gdp meeting estimates. Apparently, after earlier export data, all the good news had been absorbed. Both indexes held onto impressive gains for the week.

China met projected gdp growth target of 6.7% for the first quarter, down from last quarter’s 6.8%. (Compared to full year 2014 gdp growth of 7.3%). Growth fueled by debt, primarily for SOE’S and local government infrastructure. Per WSJ,

Higher investment in property and infrastructure is also providing a boost to many of the industries that are beset by the excess capacity government has vowed to eliminate.

While investment in factories, buildings and other fixed assets grew 10.7% over the quarter, the rate was up 23.3% for state-owned firms and only 5.7% at private firms. China’s state-owned enterprises tend to be less profitable; last year their profits fell 21.9%, compared with a 3.7% increase for private companies. And the government has made nurturing the private sector—and the job growth it brings—a priority.

Cement production rose 24% year on year in March compared with an 8.2% decline in January and February combined, while crude steel rose 2.9% last month, compared with a decline of 5.7% in January-February.

Both of these industries are on the “over-capacity” list of industries which the government has promised to curtail. Unfortunately, the conflict of interest between SOE majority ownership in these industries and SOE reform makes that less than likely. For steel alone, the China Iron & Steel Association, CISA, reported that China had a capacity surplus of around 400 million tons, with utilization rates falling to 67% in 2015. To put it in perspective, publicly traded steel major Arcelor Mittal, MT, NYX, in 2015 stated that capacity rates of it’s 4 large US hot strip mills, running at 70%, were well below optimal and would require some sort of change. (Andy Harshaw, CEO Arcelor USA).” It is not sustainable to operate multiple HSMs at low utilization rates when the same volume of steel could be produced by fewer HSMs at higher utilization rates.” Arcelor Mittal shipped 84.6 million tons of steel in 2015 per the annual report. In that same report, it was stated that China exported 112 million tons, up 18 million tons from the prior year. This was on an overall reported production decline in China of 2%. Exports were made to offset the Chinese consumption yoy decline of 4.5%.

Filings

Jiangxi Copper, HK 00358, down .922%, announces delay in circular from 3/18 to 4/15, now extending to 5/12/2016. Delay reportedly related to financial details regarding its new share issuance and confirmations over “indebtedness statement.” Got approval to issue new, non-public shares at last annual board meeting. 2016 has brought no clarity and lots of red flags:

- Profit to Owners decline of 93%.

- CFO resigns: 2/26/2016

- Litigation: 3/22/2016: Trial over monies owed to Jingxi Subsidiary. Principal and interest owed of 392.5 and 33.2 million rmb, respectively. Court ruled in Jiangxi’s favor but plaintiffs appealed. Ability to pay is another story.

See my weekend edition for more insight into this company.

China Shanshui Cement, HK 691, suspended. saga continues. The company, which has had trading suspended since May 2015 in a brutal ownership fight, filing states that corporate seal held by former directors is invalid. Is applying for new seal. In the meantime, everything signed with that seal, (origination date is unclear), is invalid – including any and all filings. As of the announcement, the company was aware of 102 lawsuits from creditors.

Great Wall Motor, HK 0233, down 2.446% responds to questions over declining gross margins from first quarter to last, risks on reliance on SUV’S. Answers aren’t pretty. Promotions and competition are the underlying causes. Haval H8 & H9, were released in 2014 and 2015 but weren’t shown under specific sales. Company states they were below expectations, with no material impact on earnings. Haval H7 was projected to launch in 2015 – no explanation had been given why it didn’t. Company stated it adjusted the schedule to April, 2016. It was also asked to explain why the gross profit margin decreased from 26.6% in q1 to 22.9% in q2. Company stated it was focusing on its SUV sales, 82% of 2015 sales, which required promotions and employee compensation increases.