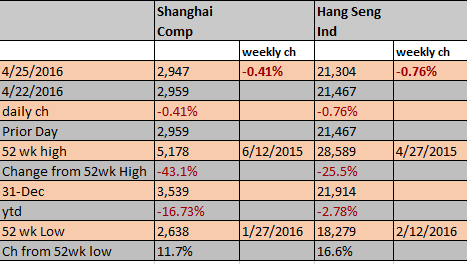

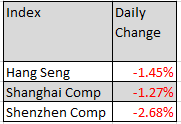

As China Vanke, 2201 HK, 000002 SH, continues to fight corporate raider Baoneng, it’s latest charge is that Baoneng has raised the money to increase its stake to 25% was done with dangerous disregard to risk. Ironically, Anbang, a 4.6% owner in China Vanke, has recently shown the same criminal disregard to risk, as its premiums sold increased by almost 5 x in June from the prior year. Anbang is the mysterious, multi-billion dollar company that tried to buy Starwood, HOT, for $14 billion. It was able to increase those premiums in June by increasing sales of high-yield hybrid policies increasing by 16x. If the reported guaranteed rate of 4.5% is correct, risk is blatant when the official deposit rate maximum in China is just 1.5% and the local stock market returns have been paltry, if any, with the Hang Seng up only .36% year to date and the Shanghai Comp down 14.76%.

As China Vanke, 2201 HK, 000002 SH, continues to fight corporate raider Baoneng, it’s latest charge is that Baoneng has raised the money to increase its stake to 25% was done with dangerous disregard to risk. Ironically, Anbang, a 4.6% owner in China Vanke, has recently shown the same criminal disregard to risk, as its premiums sold increased by almost 5 x in June from the prior year. Anbang is the mysterious, multi-billion dollar company that tried to buy Starwood, HOT, for $14 billion. It was able to increase those premiums in June by increasing sales of high-yield hybrid policies increasing by 16x. If the reported guaranteed rate of 4.5% is correct, risk is blatant when the official deposit rate maximum in China is just 1.5% and the local stock market returns have been paltry, if any, with the Hang Seng up only .36% year to date and the Shanghai Comp down 14.76%.

Vanke is obviously more concerned with Baoneng’s holdings, reported at 25% on July 6, 2016 after A shares resumed trading on July 4, 2016 and Baoneng added 78.4 million shares.

This saga is far from over as the Chairman of one of the largest developer’s in the world, Wang Shi, continues to fight to maintain control of the China Vanke he founded in the 1990s.

In case you missed it, as Baoneng, upped its ownership in Vanke, Vanke first suspended its A shares to “consider a restructure”, and then tried to sneak through a private share issue to the SOE Shenzhen Metro. The grounds for the potentially massive share issue to raise between 40 and 60 million yuan, was that Vanke desperately needed the land Shenzhen Metro was sitting on, mainly close to or connected with its metro system. Once this issuance went through, Baoneng would lose its prominence as a majority shareholder and be replaced by Shenzhen Metro as the largest shareholder. Vanke may have succeeded since Baoneng had no Board presence but was thwarted when China Re, which had 3 votes, balked at losing its percentage interest. On top of that, when Vanke caved and asked for a vote, one member abstained, a Blackstone member, claiming he had an interest in the outcome since Vanke was negotiating a purchase from Blackstone. Without that vote, the approval of the majority vote was protested by China Re, claiming that the abstention meant there was less than the required 2/3 majority.

Thankfully, the public isn’t too affected since Vanke managed to get a waiver on the 25% rule to 10%, (rules are meant to be broken), but admits that the new proposal could drop the float to below that. Based on the proposal and the last reported share holdings, it definitely will drop it.

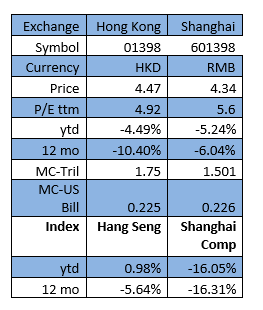

Meanwhile, despite the fact that Vanke is one of China’s largest developers, with projects dominating the 1st and 2nd tier cities, its stock has suffered more than the indexes for both the Hong Kong and Shenzhen Exchanges. (12/18/15 was the date at which the A-shares were halted. They resumed trading on July 6, 2016, despite the fact that the restructure still wasn’t concluded.)

Even the Shenzhen exchange wasn’t happy with the deal and wrote Vanke a letter with 7 problems. Vanke wrote back with the synopsis as follows: 7/4/2016

1) Re: question on the reasoning for abstention – Vanke stated that conflict of interest which is based on the fact that deal Blackstone is working on would be affected by outcome of vote.

2) Re: question of Independent Director’s Independence: Rebuts that the Indep Director is independent, Vanke states that he is independent per the rules of the Shenzhen stock exchange.

Although Blackstone shares some interests with Vanke, states that these interests are below the threshold & therefore enable the director to be classified as independent.

3) Rebuts question on lack of 2/3 majority required with the abstention. Claims that they had enough members voting without the abstaining member.Claims they needed only 50% to attend, then 2/3 of those attending to pass. 10 out of 11 voted, with 7 voting yes.

Free float under Approved Minimum & Remedy

2) Admits the free float will most likely be below the 10% (standard was 25% but they got a waiver for 10%). Based on pre-existing ownership, free-float will definitely drop below – from 11.91% to 9.45%. Company considers the .55% deficiency to be immaterial. Company has made no plans to rectify, will act once it happens – could issue more H shares.

Huge Difference between original Capital Contribution of Assets being Bought and appraised value.

3) Deal Value – Claims that value is reasonable due to sign. Land price appreciation since 2012. Since 2012, Shenzhen land price per GFA have increased by 354% while Nanshan prices have increased by 284%. In contrast, the value of Qianhai hub increased by 123% while Antuoshan increased by 44.7%

State of Development of Parcels

4) Explain where the development process, approvals obtained, is on the assets. Early progress, no construction to date, need environmental impact, etc.

Profitability

5) Notes that there has been negative to minimal profits for assets acquired The land injection was made in 2016 – development will eventually make it profitable.

Avg. Trading Price Justification

6)Rule 45 – price can’t be less than 90% of market reference price. Market reference price based on average trading of 20 days, 60 days or 120 days prior to announcement of resolutions of acquisitions. The company justified the price of 15.88 rmb/share stating that it was more than 90% of the 60 day average – prior to the suspension. This price was also supported by historical p/e, & price to net asset value. Based on history – states that the projected price is about 93% of avg.

Dilution of EPS

7) Admits that it will take time for assets to be profitable so there will most likely be a dilution of eps in the “short term”. Both are in early stages, minimum approvals to date & no construction started.

Where are they now? The latest filing, 7/21/2016, states that the Blacktone deal did go through, with China Vanke setting up a JV which would own 96% of the properties, at a cost to Vanke of RMB 3,889 million, about $582 million US. Otherwise, the last filing on July 18, 2016 regarding the restructure noted there was nothing new to report, with no approval yet from the State owned assets and Supervisory Boards, the Vanke Board and the CSRC.

In case you were wondering: What are the Baoneng Entities?

Although Baoneng has increased its ownership since the annual report, at the annual, the following entities were listed with their shares, all related to Baoneng:

As China Vanke,

As China Vanke,

China Steel Companies, already reeling from Chinese market turmoil, over-capacity and flagging demand, dropped further as the U.S. attacked with

China Steel Companies, already reeling from Chinese market turmoil, over-capacity and flagging demand, dropped further as the U.S. attacked with

T

T