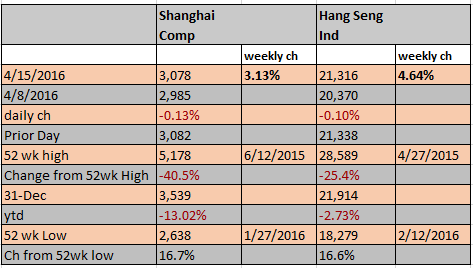

Data source: Bloomberg

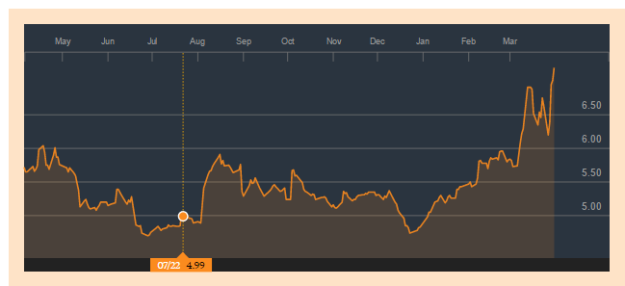

Three magic words sent a boring cement company up 34%. The three magic words were: Beijing, Tianjin and Hebei. (aka Jing-Jin-Ji).

The rocketing rise for this 2009, hong kong listing was definitely not due to its latest earnings report. (It’s Shanghai listing didn’t move thanks to a mainland holiday). Following its earnings announced on 3/29/17, the HK listing actually fell slightly from 3.39HK$ to 3.24hk$. (Shanghai went from 4.83rmb to 4.66rmb and had barely budged year to date.)

Ruling out the earnings and a lack of other news – the sole blame is the frenzy created by the PRC’S weekend announcement of a new economic zone: Xiong’an New Area. (Less catchy than Shenzhen but maybe there is a reason for that Xi.)

Per Caixin,

The Xiong’an New Area, located about 130 kilometers (80 miles) to the south of Beijing and Tianjin, forms essentially an equilateral triangle with the two municipalities. It consists mainly of three counties in Hebei province and initially covers 100 square kilometers. The plan is to ultimately expand it to 2,000 square kilometers.

Xinhua said the Xiong’an New Area is the first to be of the same national significance as the Shenzhen SEZ and the Shanghai Pudong New Area, the first national new area, which was opened 25 years ago. It didn’t explain the difference between a SEZ and a national new area.

The new area’s mission is to deepen institutional reform, explore ways to build smart and ecologically friendly cities, develop better infrastructure and efficient transportation networks, and pursue further opening-up in a comprehensive way, Xinhua said. Non-governmental functions of Beijing will be moved into an appropriate part of the zone, Xinhua said.

The details are vague and reportedly surprising. Nonetheless, it appears to have convinced the market that BBMG is poised for an outsize benefit.

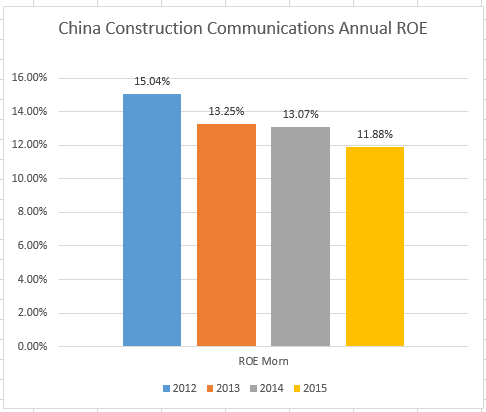

BBMG isn’t a growth company. It’s an enormous, state-controlled company producing a commodity product in an acknowledged over-capacity industry. Thanks to a recent forced absorption of less “profitable”, (read lower losses), company Jidong, it has increased its work force as well as its assets and liabilities with undocumented synergies. Indigestion in the form of lower margins, higher debt payments and unwieldy employment costs from this recently absorbed acquisition is sure to follow.

BBMG Overview

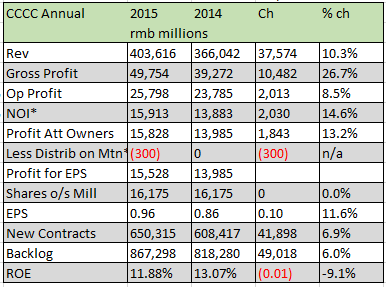

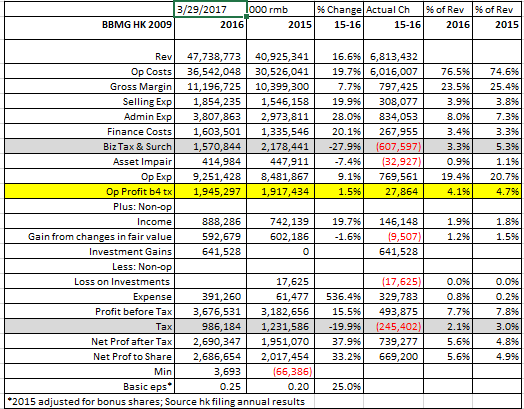

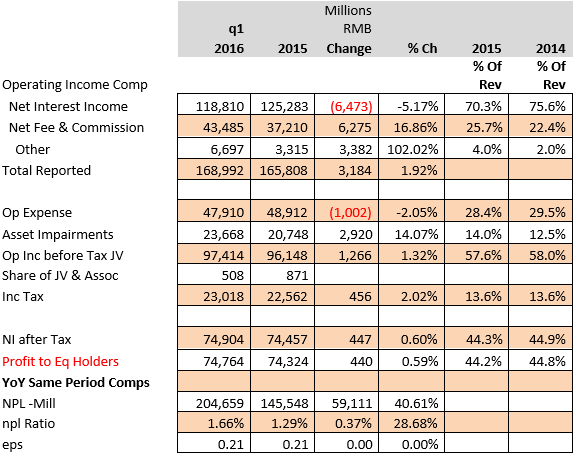

BBMG is primarily a cement producer in an over-capacity sector which does a side business in property development and management. While it showed an increase in revenue of about 16.6%, its net before taxes and various extraordinary, non-operating items rose only 1.5 %. (Even with a drop in business taxes of 28%, unexplained). It’s a behemoth of a company, majority owned and controlled by the state, which has grown from 28,619 employees to 49,721, thanks to the forced integration of Jidong. Meanwhile, its gross margins have shrunk.

As the above shows, operating profit only increased by about 1.5% despite a revenue increase of 16.6%. Despite the increase in most operating items, business tax and surcharges actually declined by 28%. The announcement fails to address this difference but without it, there would have been a decline in operating revenue.

Other Income: Subsidies

The company met its impressive 38% growth in profit thanks mainly to non-operating income items, (which it partly classified as operating, I’ve re-organized). Although no real details are given on the fair value increases or investment gains, subsidies continue to be a given. (From its annual results announcement).

Cement Volume Sales

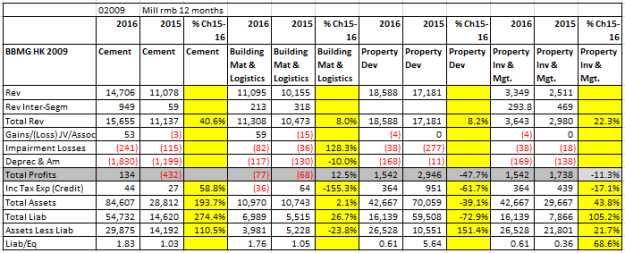

As noted, revenue increased by 16.6% for 2016. During that time, BBMG reported to selling 28.9% more cement and 14.1% concrete. Segment results from the annual are condensed as follows:

While the increase in revenues in cement is notable, the profits for this segment were a fraction of the revenues, reflecting the overall pressure on price. The more profitable sectors of property development and property investment showed an alarming decline. These segments taken separately and combined present weak evidence for investing based on profits and growth.

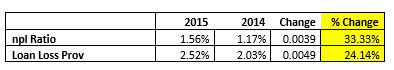

Asset Quality

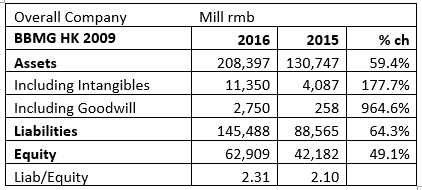

As can be seen in the segment reporting above, assets in the cement segment have increased by more than 190% while liabilities have surpassed that change with a 274% increase. The asset quality is also under pressure and opaque.

Once again, there is little detail on either Goodwill or Intangibles, which have grown significantly.

Asset quality in terms of receivables, showed an increase in bad debt and maturities.

While the economic zone designation could help BBMG in terms of increased demand for that region, it is a national player which has had marginal growth and minimal margins. The overnight rise smacks of speculation and is unwarranted.

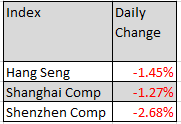

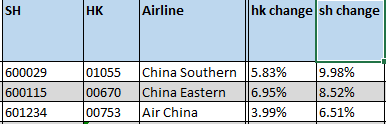

China Steel Companies, already reeling from Chinese market turmoil, over-capacity and flagging demand, dropped further as the U.S. attacked with

China Steel Companies, already reeling from Chinese market turmoil, over-capacity and flagging demand, dropped further as the U.S. attacked with