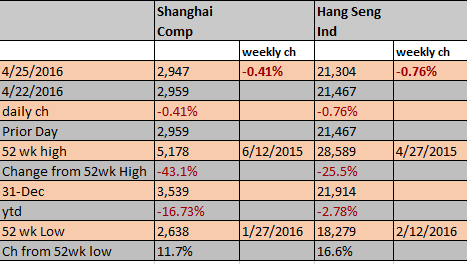

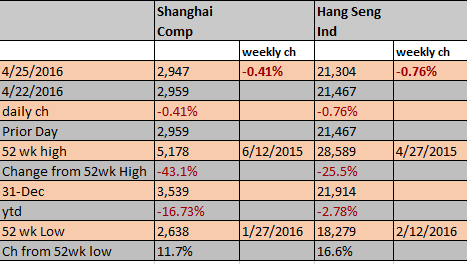

Major Chinese indexes faltered pending 1st quarter earnings reports, Wednesday’s data on March industrial profits and April consumer sentiment and mixed signals from regulators.

Commodity Bubble:

Commodity trading raised alarm bells with both Deutshe Bank and Morgan Stanley noting the spike in volume. Per Bloomberg:

The recent spike in speculative trading in commodities in China has stunned global markets, according to Morgan Stanley, which cited a jump in local activity for steel, iron ore and cotton as well as eggs and garlic.

“Now China’s speculators engage commodities,” analysts including Tom Price and Joel Crane said in an e-mailed note on Monday. “China’s latest speculative spike has stunned global markets.”

To put it in perspective, also per Bloomberg:

“The fact that trading volume for steel rebar contracts was at 223 million tons of rebar last Thursday, more than China’s full-year production of steel rebar, raised concerns about the repeat of boom-bust scenario seen last year in China’s equity market,” analysts at Oversea-Chinese Banking Corp. wrote in a note on Monday.”

Finally, a picture courtesy Zerohedge:

Banks and Property Agencies Under Pressure to Slow Shanghai Skyrocketing Prices

Per Bloomberg,

China’s banking regulator in Shanghai is halting business between commercial banks and six real estate agencies for a month, the latest in a string of measures to contain risks in the housing market.

The suspension, which takes effect Monday, covers agencies including the local arms of Beijing Homelink Real Estate Brokerage Co., Pacific Rehouse Co. and Shanghai Hanyu Property Brokerage Co., according to a statement by the China Banking Regulatory Commission’s Shanghai office on the city’s official Weibo microblog account.

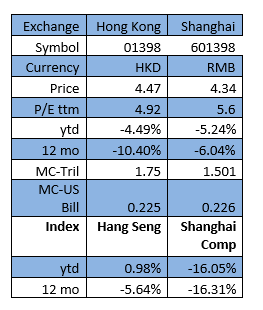

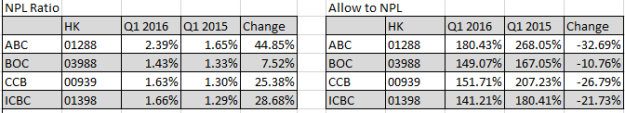

In the same account, branches for two of China’s largest lenders, Industrial and Commercial Bank of China, 1398 hk, and Bank of China, 3988 hk, along with HSBC are suspended from issuing mortgages for the next two months. The reasoning given eerily echoes the subprime meltdown as:

China’s central bank Governor Zhou Xiaochuan last month told banks to better assess customer creditworthiness in mortgage lending to reduce risks, adding that unauthorized loans by real estate agents increased the chances of bad debts.

While the overall management on residential mortgage loans is “relatively prudent,” some real estate agents advanced the transactions by providing down-payment loans and bridge loans, the statement said. Some commercial banks also violated rules with their practices on mortgage loans, according to the statement.

China Eastern Stalls Again

Despite the news that CTRIP, CTRP NYEX, is stepping up to invest about 3Billion rmb’s into China Eastern, 670 hk, the stock swooned ovef 5% today while China Southern, 1055 HK, dropped 1.2%, and Air China, 753, hk dropped 2.5%. The air pocket could be due partly to the following:

- The 3Billion rmb is just a small portion of the 15 Billion China Eastern announced it would raise with a new, private A-share offering. Approved by the CSRC in January of 2016 with this investment being the first actual investment since then. The bulk of the money is needed to buy 23 new planes.

- China Eastern faced headwinds when it tried to buyback 3.3 Billion yuan notes due March 2017, 4.8%, guaranteed. After offering to buy via a dutch Auction with a minimum price under par, the company got no quorum and amended the offer to par + accrued interest and extended the offer to 4/27/2016. (The bonds were issued in March, 2014, to professional investors).

- The company has been issuing super-short term notes to finance working capital while it waits for the proposed shares to be bought to finance its expansion. In April alone it issues 4 separate tranches totalling 12 billion rmb. Since the beginning of 2016, it has issued 19.5 Billion in super short term notes, generally refinancing existing debt.

T

T