After a series of moves and reviews, the big 5 Chinese banks blasted upwards in February, outpacing the rocketing Hang Seng. Over the past couple of days, however, they’ve retrenched. If Morgan Stanley and Short trading interest are to be believed, this is a temporary reversal.

The banks include:

| Name | Acronym | HK symbol |

| Industrial & Commercial Bank of China | ICBC | 1398 |

| China Construction Bank | CCB | 939 |

| Agricultural Bank of China | ABC | 1288 |

| Bank of China | BOC | 3988 |

| Bank of Communications | BOCOM | 3328 |

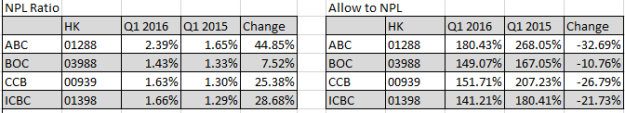

Despite rising Non performing loans, shrinking net interest margins and capital requirements, these banks have surpassed the rising Hang Seng thanks to interest rate rises, increased lending, China stimulus and PPI rises.

Timeline of positive factors:

1/24/2017 – Interest rates raised on medium term rates on loans.

2/03/2017 – Interest rates raised on short-term debt, reportedly in the interests of liquidity due to perceived resulting from the Chinese New Year.

2/14/2017 – Morgan Stanley published a bullish report on China Banks. Banks.

2/15/2017 – Bloomberg reported that options trading reacted positively to the bullish stance of Morgan Stanley on the big 4 banks, (all of banks listed above excluding BOCOM, which isn’t included in the big 4).

None of these banks have reported annual earnings. While earnings seasons has just about ended in the US, annual earnings reports for Hong Kong listed stocks are trickling in. Regardless of the annual earnings, they won’t reflect the February 2017 change in interest rates and producer price inflation which Morgan Stanley reports.

Given the significant decline in short-term selling ratios for all but BOC, 3988 HK, the recent drop could signify a temporary drop versus a long-term decline. At least for the short-term.

T

T